Common mistakes

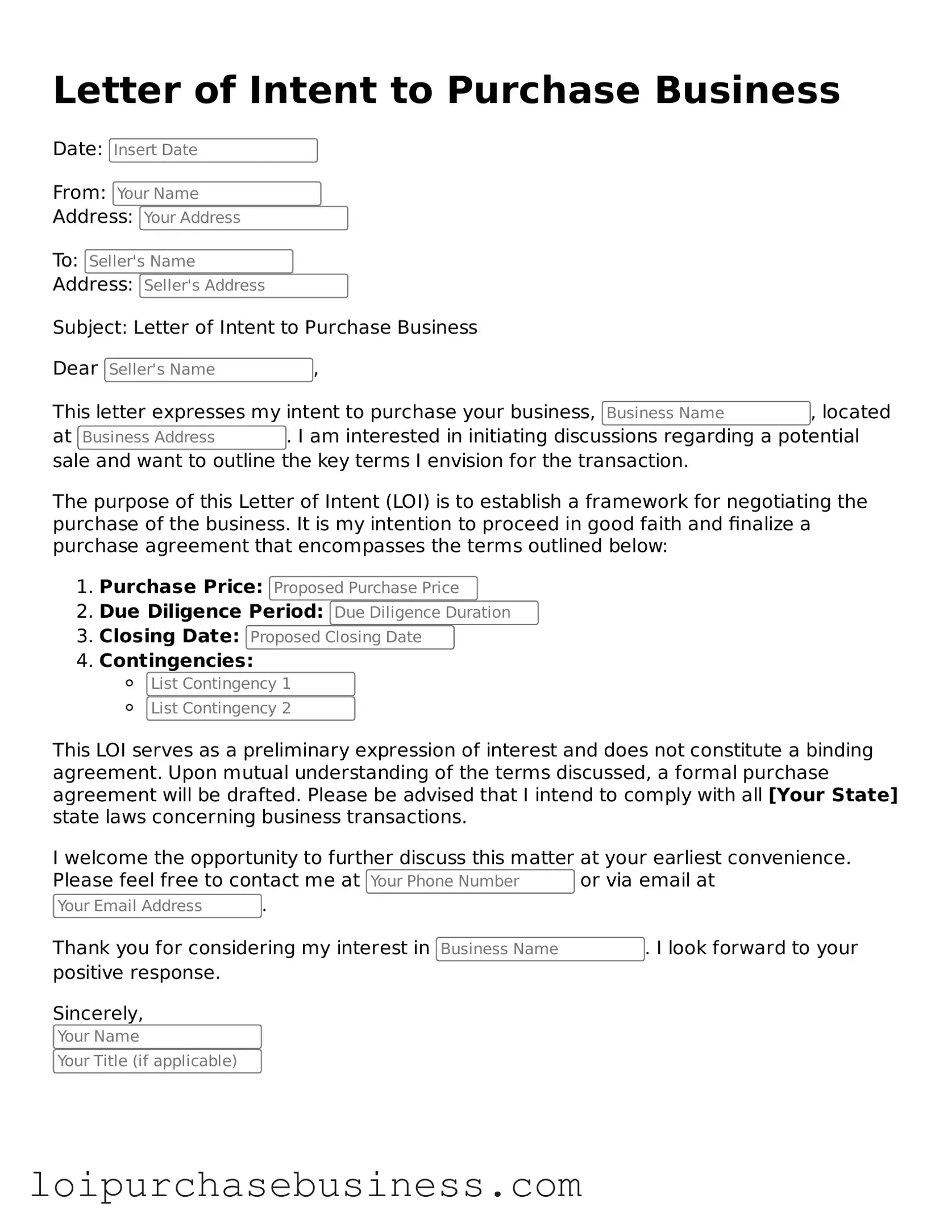

Filling out a Letter of Intent (LOI) to Purchase a Business can be a crucial step in the acquisition process. However, many individuals make common mistakes that can lead to misunderstandings or complications later on. One prevalent error is failing to provide clear and specific details about the business being purchased. Vague descriptions can create confusion and may lead to disputes down the line. When outlining the terms of the purchase, it is essential to be as precise as possible to ensure that all parties are on the same page.

Another frequent mistake is neglecting to include essential financial information. Potential buyers often overlook the importance of detailing the purchase price, payment terms, and any contingencies that may affect the transaction. This omission can result in misaligned expectations and hinder negotiations. Buyers should ensure that they include all relevant financial terms to create a solid foundation for the agreement.

Additionally, some individuals fail to consider the importance of including a timeline for the transaction. Without a clear timeline, the process can become disorganized and prolonged. Establishing deadlines for due diligence, financing, and closing can help keep all parties accountable and focused. A well-defined timeline not only aids in project management but also fosters a sense of urgency that can be beneficial in negotiations.

Lastly, many people forget to seek professional advice when drafting their LOI. While it may seem straightforward, the implications of an LOI can be significant. Consulting with a legal or financial advisor can provide valuable insights and help avoid pitfalls that could jeopardize the transaction. Engaging professionals ensures that the document is comprehensive and aligns with the buyer's goals, ultimately leading to a smoother acquisition process.